Unemployment Claims: Check your eligibility criteria, benefits amount, state unemployment office contact information, and other frequently asked questions here.

Select your state:

You are trying to load a table of an unknown type. Probably you did not activate the addon which is required to use this table type.

NOTE: Some States may have changed the benefits criteria and amounts recently. In those cases, you need to check with your State’s Employment Agency for the current information.

Duration And Unemployment Benefits By State

The Unemployment Insurance (UI) benefits are given to those who have lost their jobs through no fault of their own. Though the U.S. Department Of Labor oversees the UI program and ensures compliance within each state, the state governments administer and determine the eligibility criteria, benefit amount and duration.

This table provides a complete list of minimum and maximum weekly unemployment benefits and duration for all 50 states. It provides details on the unemployment rate and maximum dearness allowance across all the states.

Comparison of State Unemployment Benefits

| State | Unemployment Rate (%) | Max. Weeks of Benefits | Max. Weekly Benefits | Max. Dearness Allowance |

Min.

Weekly Benefits

|

| Alabama | 3.6 | 26 | $275 | N/A | $45 |

| Alaska | 6.7 | 26 | $370 | $72 | $56 |

| Arizona | 6.7 | 20 | $240 | N/A | $187 |

| Arkansas | 4.4 | 16 | $451 | N/A | $81 |

| California | 8.3 | 26 | $450 | N/A | $50 |

| Colorado | 6.4 | 26 | $649 | N/A | N/A |

| Connecticut | 8.1 | 26 | $667 | $75 | $75 |

| Delaware | 6.4 | 26 | $400 | N/A | $20 |

| Florida | 4.8 | 12 | $275 | N/A | N/A |

| Georgia | 4.3 | 20 | $365 | N/A | $55 |

| Hawaii | 8.5 | 26 | $648 | N/A | $5 |

| Idaho | 3.1 | 20 | $414 | N/A | N/A |

| Illinois | 7.1 | 26 | $505 | $178 | N/A |

| Indiana | 3.9 | 26 | $390 | N/A | $50 |

| Iowa | 3.8 | 26 | $493 | $106 | $73 |

| Kansas | 3.5 | 26 | $488 | N/A | $122 |

| Kentucky | 4.7 | 26 | $560 | N/A | $39 |

| Louisiana | 7.3 | 26 | $247 | N/A | $101 |

| Maine | 4.8 | 26 | $462 (till May 31,2021) | $215 | N/A |

| Maryland | 6.2 | 26 | $430 | N/A | $50 |

| Massachusetts | 6.5 | 30 | $855 | $397 | N/A |

| Michigan | 4.9 | 20 | $362 | $209 | $209 |

| Minnesota | 4.1 | 26 | $762 | N/A | N/A |

| Mississippi | 6.2 | 26 | $235 | N/A | $30 |

| Missouri | 4.1 | 20 | $320 | N/A | N/A |

| Montana | 3.7 | 28 | $552 | N/A | $163 |

| Nebraska | 2.8 | 26 | $440 | N/A | N/A |

| Nevada | 8.0 | 26 | $469 | N/A | N/A |

| New Hampshire | 2.8 | 26 | $427 | N/A | $32 |

| New Jersey | 7.5 | 26 | $713 | N/A | N/A |

| New Mexico | 8.2 | 26 | $484 | $50 | $90 |

| New York | 8.2 | 26 | $504 | N/A | $172 |

| North Carolina | 5.0 | 20 | $350 | $50 | $50 |

| North Dakota | 4.2 | 26 | $618 | N/A | N/A |

| Ohio | 4.7 | 26 | $480 | $155 | $140 |

| Oklahoma | 4.3 | 26 | $520 | N/A | N/A |

| Oregon | 6.0 | 26 | $648 | N/A | $151 |

| Pennsylvania | 7.4 | 26 | $572 | $8 | $8 |

| Rhode Island | 6.3 | 26 | $599 | $144 | $59 |

| South Carolina | 5.0 | 20 | $326 | N/A | $42 |

| South Dakota | 2.8 | 26 | $428 | N/A | $28 |

| Tennessee | 5.0 | 26 | $275 | N/A | N/A |

| Texas | 6.7 | 26 | $535 | N/A | $70 |

| Utah | 2.8 | 26 | $560 | N/A | N/A |

| Vermont | 2.9 | 26 | $513 | N/A | N/A |

| Virginia | 4.7 | 26 | $378 | N/A | $60 |

| Washington DC | 7.5 | 26 | $444 | N/A | N/A |

| Washington | 6.1 | 26 | $844 | N/A | $201 |

| West Virginia | 5.8 | 26 | $424 | N/A | $24 |

| Wisconsin | 3.0 | 26 | $370 | N/A | $54 |

| Wyoming | 5.4 | 26 | $508 | N/A | $36 |

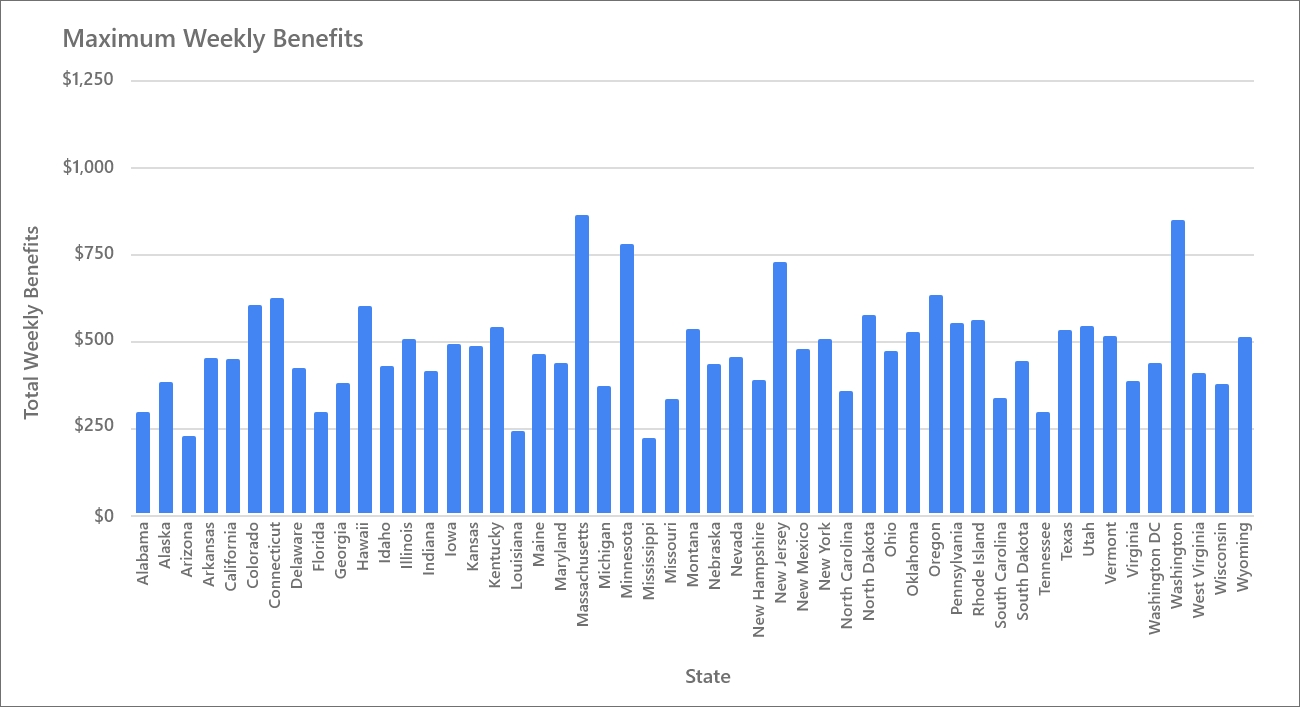

Benefits Comparison Chart

The following comparison data provides an overview of benefits and shows which states pay well:

Note – The benefit amount you would receive depends on factors like your wages in your base period, number of dependents, and the wages you earn while collecting UI benefits (if any). Use the benefits calculator to determine your estimated Weekly Benefit Amount (WBA).

States That Pay The Highest And Lowest Unemployment Insurance Compensation

- Massachusetts – $855

- Ohio – $673

- Washington – $844

States That Pay The Lowest Unemployment Insurance Compensation

- Mississippi – $235

- Arizona – $240

- Louisiana – $247

States That Provide Unemployment Compensation For A Longer And Shorter Duration

- Massachusetts – 30 Weeks

- Montana – 28 Weeks

States That Provide Unemployment Compensation For A Shorter Duration

- Florida – 12 Weeks

- Arkansas – 16 Weeks

Why The Benefit Amount Varies From One State To Another?

The major reason for variation in the benefit amount from one state to another is the UI replacement rate. UI replacement rate is nothing but the percentage of your previously earned income replaced by the unemployment benefits. For instance, in 2019, D.C. average UI replacement was 21%, whereas Hawaii’s replacement rate was 55%.

How Do States Calculate Your Weekly Benefit Amount?

Alabama

The state calculates your Weekly Benefit Amount by dividing your wages in the two highest quarters of the base period by 26 and rounding it to the next whole dollar. If you collect wages while on UI benefits, the state will disregard an amount equal to 1/3 of your WBA.

Alaska

The state uses a worksheet to calculate your Weekly Benefit Amount. If you collect wages while on UI benefits, the state will disregard $50 in addition to the 1/4th of wages above $50.

Arizona

Your Weekly Benefit Amount in Arizona would be 4% of your wages in your highest quarter of the base period. If you collect wages while on UI benefits, the state will disregard $30.

Arkansas

Your Weekly Benefit Amount in Arkansas is determined by dividing your average wages over the four quarters of your base period by 26 and rounding it to the nearest whole dollar. If you collect wages while on UI benefits, the state will disregard an amount equal to 40% of your WBA.

California

The state uses a Unemployment Benefits calculator to determine your Weekly Benefit Amount. If you collect wages while on UI benefits, the state will disregard $25 or 1/4th of earnings, whichever is greater.

Colorado

Your Weekly Benefit Amount in Colorado would be the highest value from two approaches: 50% of average weekly earnings from the past 12 months or 60% of average weekly earnings for the highest two consecutive quarters. If you collect wages while on UI benefits, the state will disregard an amount equal to 25% of your WBA.

Connecticut

Your Weekly Benefit Amount in Connecticut is determined by dividing your average earnings in your two highest latest quarters by 26. If you collect wages while on UI benefits, the state will disregard 1/3rd of your weekly earnings.

Delaware

Your Weekly Benefit Amount in Delaware is determined by dividing your average earnings in your two highest latest quarters by 46. If you collect wages while on UI benefits, the state will disregard $10 or 50% of your weekly benefit, whichever is greater.

The District of Columbia

Your Weekly Benefit Amount in District of Columbia is determined by dividing your earnings in the highest quarter of your base period by 26. If you collect wages while on UI benefits, the state will disregard 1/3 of wages plus $50.

Florida

Your Weekly Benefit Amount in Florida is determined by dividing your earnings in the highest quarter of your base period by 26. If you collect wages while on UI benefits, the state will disregard 8 x Federal hourly minimum wage.

Georgia

Your Weekly Benefit Amount in Georgia is determined by dividing your two highest earning quarters by 42, or your earnings in your highest earning quarter by 21. If you collect wages while on UI benefits, the state will disregard $50.

Hawaii

Your Weekly Benefit Amount in Hawaii is determined by dividing your earnings in the highest quarter of your base period by 21. If you collect wages while on UI benefits, the state will disregard $150.

Idaho

Your Weekly Benefit Amount in Idaho is determined by dividing your earnings in your highest quarter of the base period by 26. If you collect wages while on UI benefits, the state will disregard an amount equal to 50% of your WBA.

Illinois

Your Weekly Benefit Amount in Illinois would be 47% of your average weekly wages in the two highest quarters of your base period. If you collect wages while on UI benefits, the state will disregard an amount equal to 1/2 of your WBA.

Indiana

Your Weekly Benefit Amount in Indiana would be 47% of your average weekly wages in the base period. If you collect wages while on UI benefits, the state will disregard an amount equal to 20% of your WBA from sources other than employers in your base period.

Iowa

Your Weekly Benefit Amount in Iowa is determined by dividing your earnings in your highest quarter of the base period by 23, more if you have dependents. If you collect wages while on UI benefits, the state will disregard an amount equal to 1/2 of your WBA.

Kansas

Your Weekly Benefit Amount in Kansas would be 4.25% of your wages in the highest quarter of your base period. If you collect wages while on UI benefits, the state will disregard an amount equal to 1/4th of your WBA.

Kentucky

Your Weekly Benefit Amount in Kentucky would be 1.1923% of your wages in the base period. If you collect wages while on UI benefits, the state will disregard 1/5th of your earnings.

Louisiana

Your Weekly Benefit Amount in Louisiana is determined by dividing your average wages over the last four quarters of your base period by 25 and multiplying by 1.2075. If you collect wages while on UI benefits, the state will disregard $50 or an amount equal to 1/2 of your WBA, whichever is less.

Maine

Your Weekly Benefit Amount in Maine is determined by dividing your wages in your two highest recent quarters by 22. If you collect wages while on UI benefits, the state will disregard $100.

Maryland

Your Weekly Benefit Amount in Maryland is determined by dividing your wages in the highest quarter of your base period by 24. If you collect wages while on UI benefits, the state will disregard $50.

Massachusetts

Your Weekly Benefit Amount in Massachusetts would be 1/2 of your average weekly earnings. If you collect wages while on UI benefits, the state will disregard an amount equal to 1/3rd of your WBA.

Michigan

Your Weekly Benefit Amount in Michigan would be 4.1% of your wages in the highest quarter of your base period. If you collect wages while on UI benefits, the state will disregard 1/2 of wages.

Minnesota

Your Weekly Benefit Amount in Minnesota would be 50% of 1/52 of your average weekly wages in your base period or 50% of 1/13 of your wages in the highest quarter of your base period, whichever is higher. If you collect wages while on UI benefits, the state will disregard 1/2 of wages.

Mississippi

Your Weekly Benefit Amount in Mississippi is determined by dividing your wages in the highest quarter of your base period by 26. If you collect wages while on UI benefits, the state will disregard $40.

Missouri

Your Weekly Benefit Amount in Missouri is determined by dividing your average wages in your two highest recent quarters by 25. If you collect wages while on UI benefits, the state will disregard an amount equal to 20% of your WBA or $20, whichever is greater.

Montana

Your Weekly Benefit Amount in Montana would be 1% of your wages in your base period, or 1.9% of your wages in the latest two highest quarters. If you collect wages while on UI benefits, the state will disregard an amount equal to 1/4th of your WBA.

Nebraska

Your Weekly Benefit Amount in Nebraska would be 1/2 of your average wages each week. If you collect wages while on UI benefits, the state will disregard an amount equal to 1/2 of your WBA.

Nevada

Your Weekly Benefit Amount in Nevada is determined by dividing your earnings in the highest quarter of your base period by 25. If you collect wages while on UI benefits, the state will disregard 1/4 of your earnings.

New Hampshire

Your Weekly Benefit Amount in New Hampshire would be 1% to 1.1% of your annual wages.

If you collect wages while on UI benefits, the state will disregard 30% of your WBA

New Jersey

Your Weekly Benefit Amount in New Jersey would be 60% your average weekly earnings in the base period. If you collect wages while on UI benefits, the state will disregard 20% of your WBA or $5, whichever is greater.

New Mexico

Your Weekly Benefit Amount in New Mexico would be 53.5% of your average weekly earnings in the highest paid quarter of your base period. If you collect wages while on UI benefits, the state will disregard 1/5th of your WBA.

New York

Your Weekly Benefit Amount in New York would be 1/25th to 1/26th of your wages in the highest quarter of your base period. If you collect wages while on UI benefits, the state will disregard none.

North Carolina

Your Weekly Benefit Amount in North Carolina is determined by dividing your total wages in the recent two quarters by 52. If you collect wages while on UI benefits, the state will disregard 20% of your WBA.

North Dakota

Your Weekly Benefit Amount in North Dakota would be 1/65th of the total of your wages in the two highest quarters plus half of your wages in your third highest quarter. If you collect wages while on UI benefits, the state will disregard 60% of your WBA.

Ohio

Your Weekly Benefit Amount in Ohio would be half of your average weekly earnings from the base period. If you collect wages while on UI benefits, the state will disregard 1/5th of your WBA.

Oklahoma

Your Weekly Benefit Amount in Oklahoma would be 1/23rd or your wages in the highest quarter of your base period. If you collect wages while on UI benefits, the state will disregard $100.

Oregon

Your Weekly Benefit Amount in Oregon would be 1.25% of your wages from the base period.

If you collect wages while on UI benefits, the state will disregard $125 or 1/3rd of your WBA, whichever is greater.

Pennsylvania

Your Weekly Benefit Amount in Pennsylvania would be 4% of your wages in your highest quarter of the base period plus 2, multiplied by 0.98. If you collect wages while on UI benefits, the state will disregard $21 or 30% of your WBA, whichever is greater.

Puerto Rico

Your Weekly Benefit Amount in Puerto Rico would be 1/11th to 1/26th of your wages in the highest quarter of your base period. If you collect wages while on UI benefits, the state will disregard the full WBA

Rhode Island

Your Weekly Benefit Amount in Rhode Island would be 3.85% of the average of your wages in the two highest quarters of your base period. If you collect wages while on UI benefits, the state will disregard 1/5th of your WBA.

South Carolina

Your Weekly Benefit Amount in South Carolina would be 1/2 of your highest quarter weekly earnings. If you collect wages while on UI benefits, the state will disregard 1/4th of your WBA.

South Dakota

Your Weekly Benefit Amount in South Dakota is determined by dividing your wages in the highest quarter of your base period by 26. If you collect wages while on UI benefits, the state will disregard 1/4th of your earnings over $25.

Tennessee

Your Weekly Benefit Amount in Tennessee is determined by dividing your wages in the highest quarter of your base period by 26. If you collect wages while on UI benefits, the state will disregard $50 or 1/4th of your WBA, whichever is greater.

Texas

Your Weekly Benefit Amount in Texas is determined by dividing your wages in the highest quarter of your base period by 25. If you collect wages while on UI benefits, the state will disregard $5 or 1/4th of your WBA, whichever is greater.

Utah

Your Weekly Benefit Amount in Utah is determined by dividing your wages in the highest quarter of your base period by 26 minus $5. If you collect wages while on UI benefits, the state will disregard 30% of your WBA.

Vermont

Your Weekly Benefit Amount in Vermont would be 1/45th of your wages in your two highest quarters. If you collect wages while on UI benefits, the state will disregard 1/2 of gross wages.

Virginia

Your Weekly Benefit Amount in Virginia is determined by dividing your wages in the highest quarter of your base period by 26. If you collect wages while on UI benefits, the state will disregard 1/4th of earnings over $15.

Washington

Your Weekly Benefit Amount in Washington would be 3.85% of average wages in the highest two quarters of your base period. If you collect wages while on UI benefits, the state will disregard 1/4th of earnings over $5.

West Virginia

Your Weekly Benefit Amount in West Virginia would be 55% of 1/52nd of median earnings in your wage class. If you collect wages while on UI benefits, the state will disregard $60.

Wisconsin

Your Weekly Benefit Amount in Wisconsin is determined by dividing your wages in the highest quarter of your base period by 25. If you collect wages while on UI benefits, the state will disregard $30 plus 33% of wages over $30.

Wyoming

Your Weekly Benefit Amount in Wyoming is determined by dividing your wages in the highest quarter of your base period by 25. If you collect wages while on UI benefits, the state will disregard 50% of your WBA.

Note – The above data was collected from various government websites. There may be some minor errors and you are advised to contact your state employment office for the most accurate and up-to-date information.

How To Apply For Unemployment Benefits?

You can file for unemployment benefits online, by phone, or by visiting your nearest unemployment office. Visit your Department Of Labor website to know more about applying for unemployment benefits in your state.

What To Do If Your Claim Is Denied?

You can file an unemployment appeal if your claim was denied but you believe that you qualify for the UI program. You can appeal in writing or by mail. Continue to file weekly certification during the appeal process. That is because you will receive benefits for weeks you claimed if you win the appeal process.